Exporting goods from Pakistan can be a profitable opportunity for manufacturers, traders, and startups. However, many beginners struggle because they are not aware of the basic export documents required. While documentation can vary depending on the product type and destination country, there is a general set of documents required for almost all exports from Pakistan.

This guide explains those documents in simple terms.

1. Business Registration Documents

To start exporting, your business must be legally registered in Pakistan. This includes:

- National Tax Number (NTN)

- Company registration certificate or sole proprietorship proof

- Sales tax registration (if applicable)

These documents prove that your business is legally allowed to trade.

2. Registration with Pakistan Customs

Every exporter must be registered with Pakistan Customs. This allows you to file export declarations and clear shipments legally.

Most registrations are now done online through official systems, making the process faster and more transparent.

3. Pakistan Single Window (PSW) Registration

The Pakistan Single Window (PSW) is a digital platform that connects exporters with customs, banks, and regulatory authorities.

PSW registration is mandatory for exporters and helps manage export documentation electronically.

4. Commercial Invoice

The commercial invoice is one of the most important export documents. It includes:

- Seller and buyer details

- Product description

- Quantity and value

- Payment terms

Customs authorities in both countries use this document for valuation and clearance.

5. Packing List

A packing list provides details about how the goods are packed. It includes:

- Number of packages

- Weight and dimensions

- Packaging type

This document helps customs officials and shipping companies handle the cargo correctly.

6. Certificate of Origin

The Certificate of Origin confirms that the goods are manufactured or produced in Pakistan. It is usually issued by:

- Chambers of Commerce

- Trade bodies

Many importing countries require this document for customs clearance or duty benefits.

7. Shipping Document (B/L or Airway Bill)

This document is issued by the shipping line or airline. It serves as:

- Proof of shipment

- Transport contract

- Ownership document

The type depends on whether the shipment is by sea or air.

8. Banking and Payment Documents

Depending on the payment method, exporters may need:

- Letter of Credit (LC)

- Bank E-Form

- Export proceeds realization documents

Banks play a key role in legal export transactions.

9. Inspection, Quality, or Product-Specific Certificates

Some products require additional certificates, such as:

- Quality or inspection certificates

- Health or safety certificates

- Halal, FDA, CE, or other compliance documents

These requirements depend on the product and destination country.

10. Country-Specific Import Requirements

Every country has its own import rules. Exporters must check:

- HS codes

- Import regulations of the destination country

- Special documentation requirements

What is acceptable in one country may not be allowed in another.

Conclusion

Export documentation is the foundation of successful international trade. While this list covers the general documents required to export from Pakistan, requirements may change depending on the product category and target market.

For smooth exports, beginners should stay updated, work with licensed clearing agents when needed, and always follow legal procedures. Proper documentation not only avoids delays but also builds trust with international buyers.

Author Profile

Latest entries

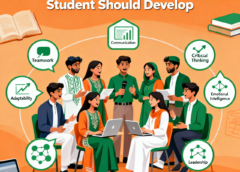

BlogDecember 30, 2025Soft Skills Every Pakistani Student Should Develop

BlogDecember 30, 2025Soft Skills Every Pakistani Student Should Develop BlogDecember 29, 2025Export Without Confusion: Common Export Terms Explained Simply

BlogDecember 29, 2025Export Without Confusion: Common Export Terms Explained Simply BlogDecember 29, 2025Top Export Products from Pakistan with High Global Demand

BlogDecember 29, 2025Top Export Products from Pakistan with High Global Demand BlogDecember 28, 2025How to Start Exporting from Pakistan: A Step-by-Step Beginner Guide

BlogDecember 28, 2025How to Start Exporting from Pakistan: A Step-by-Step Beginner Guide